The Financial Blueprint: How Modular Construction Is Reshaping Accounting, ROI, and ESG Reporting

Modular Construction: Driving Financial Innovation with OSBOS

Modular construction is more than just a building trend—it’s transforming financial management in construction technology. As CFOs, developers, and project managers adopt AI in accounting, finance automation tools, and digital transformation in real estate, modular building delivers powerful advantages in cost control, ROI optimization, and ESG reporting. Positioned at the intersection of green construction, construction fintech, and predictive analytics, modular construction is ushering in a new era of efficiency and transparency.

Accelerated Revenue Recognition & Cash Flow Gains

Faster Turnaround = Earlier Profits

By combining on-site groundwork with off-site modular manufacturing, projects reach occupancy faster than traditional builds. This enables speedier revenue recognition, improved cash flow forecasting, and enhanced financial reporting automation—key construction finance trends in 2025.

Lower Financing Pressure

Shorter project cycles reduce borrowing periods and construction financing costs, enhancing profitability and improving ROI. Investors in green real estate benefit from lower interest burdens, strengthening project viability and accelerating payback.

Cost Accounting & Efficiency Improvements

Precise Cost Tracking

Modular construction reduces material waste and dependency on manual labor, improving cost accounting accuracy and profit margins. These efficiency metrics are essential to sustainable construction accounting models.

Bulk Procurement at Scale

Modules allow centralized procurement, giving ERP automation systems better oversight of spending while maintaining consistent cost accounting benchmarks.

ESG-Focused Efficiency

Reduced waste aligns with carbon accounting, sustainability KPIs, and green building certifications, enabling companies to demonstrate measurable ESG progress through sustainability reporting software.

Forecasting & Predictive Analytics

Predictable modular timelines enable data-driven financial planning and analysis (FP&A). AI-powered accounting tools can feed real-time dashboards for CFOs, supporting cash flow optimization and budget variance analysis. Modular adoption also enhances predictive analytics in construction finance, improving business agility.

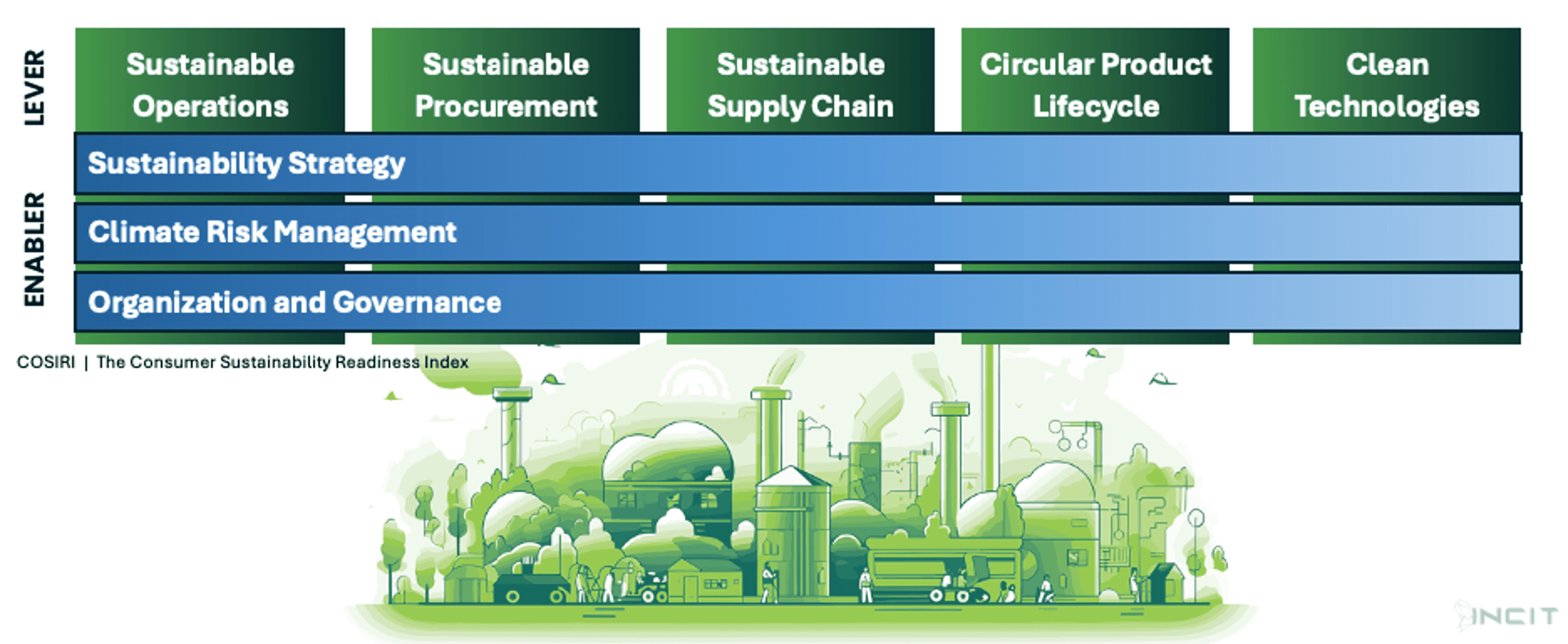

ESG Reporting & Sustainability Accounting

Sustainability Compliance in Action

Modular projects reduce energy usage and waste, simplifying ESG compliance and qualifying for green finance frameworks.

Lifecycle Cost Efficiencies

Repurposable modular units extend asset lives, improve capital expenditure planning, and unlock long-term ROI.

Regulatory & Incentive Benefits

Many modular builds qualify for ESG-linked tax incentives, carbon credits, and sustainability-driven financing, offering measurable advantages in compliance reporting.

Risk Management & Compliance Assurance

Minimized Warranty Claims

Factory-controlled environments reduce defects, lowering post-construction risk and warranty liabilities.

Audit-Ready Systems

Standardized inspections strengthen audit compliance and align seamlessly with financial reporting regulations, a key priority in construction finance transformation.

Flexibility, Scalability & Digital Finance Integration

Modular + Automation

Hybrid modular models integrate with ERP accounting systems, AI bookkeeping tools, and digital construction platforms, reflecting broader digital transformation in construction finance.

Project Scalability

From multifamily residential units and healthcare facilities to commercial towers, modular adapts across scales while feeding cost data into advanced financial analytics platforms.

Challenges & Financial Trade-Offs

-

CapEx-Intensive Upfront Costs: Requires careful project financing strategies and amortization planning.

-

Logistics & Transportation Costs: Must be addressed in project-based accounting software.

-

Perception Challenges: Can be mitigated with ROI-focused financial models and construction fintech solutions highlighting modular’s financial advantages.

Conclusion: When Modular Meets Financial Innovation

In 2025, modular construction bridges construction technology, AI in finance, and sustainability accounting like never before. Developers gain faster paybacks, investors achieve optimized ESG-linked returns, and accountants benefit from cleaner compliance reporting with finance automation solutions. For the construction industry, modular construction is the blueprint for green, profitable, and future-ready financial management—powered by OSBOS.

USA

USA UK

UK Australia

Australia UAE

UAE Canada

Canada